By AnnMarie McIlwain, Founder and CEO, www.careerfuel.net

If you are a small business owner or an aspiring entrepreneur you might be wondering what you need to know about the new crowdfunding law. If so, keep reading!

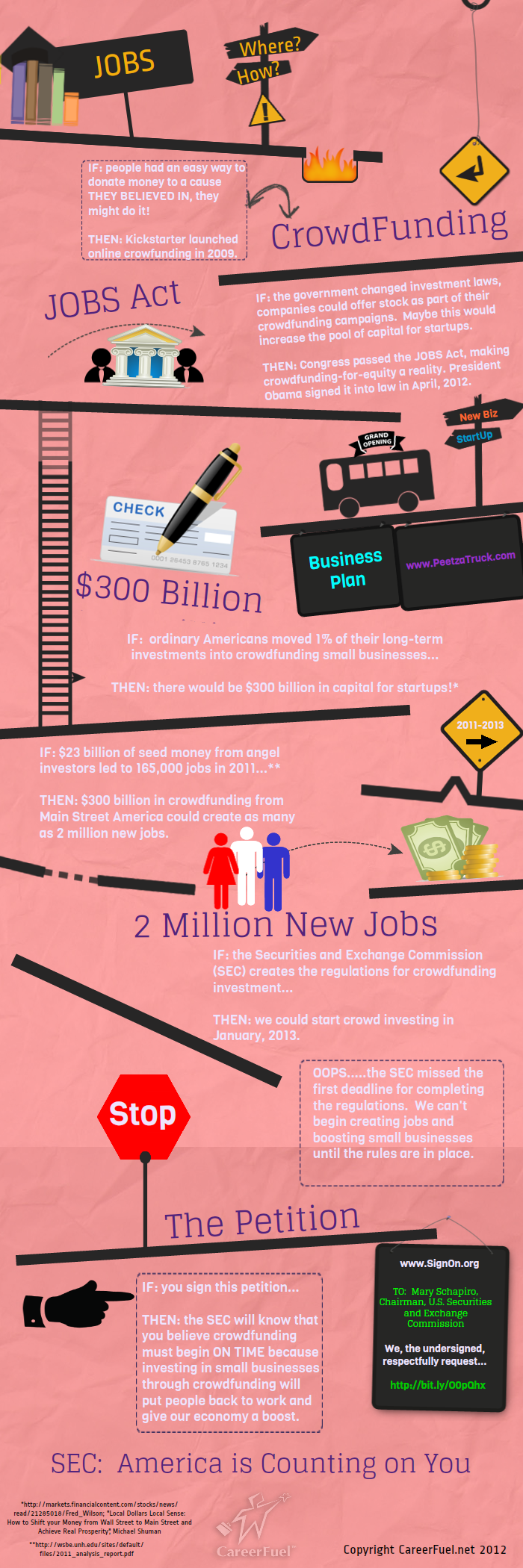

*The JOBS Act was signed into law on April 5, 2012. One of the Act’s provisions will allow startups to raise capital using crowdfunding. The basic idea is that entrepreneurs will be able to offer equity in exchange for investments in their startup. At present, startups can raise an unlimited amount of money using crowdfunding, but they cannot offer equity. Today’s incentives range from free product, to tee-shirts and karma.

*The Securities and Exchange Commission (SEC) has until December 31, 2012 to create regulations for how crowdfunding will be executed. Fall 2012 is the earliest time this might be completed, but realistically it is expected to take until year’s end.

*Money can only be raised through brokers or on Internet “funding portals” (such asKickstarter and HelpersUnite) registered with the government. Entrepreneurs cannot go directly to consumers to crowdfund for equity.

*Monies raised are dispersed if they achieve their stated goal. So, if a company’s fundraising goal is $500,000 in 30 days and they only raise $490,000 at the end of 30 days, then the company does not receive any funds and the crowdfunded investments are returned to the individual investors.

*Entrepreneurs can raise $1M every 12 months until they reach $10M in total assets.

*The entrepreneur can decide how much equity is being offered in exchange for the total investment being raised.

*The SEC will need to rule on whether any or all crowdfunding investors will count toward the 2,000-investor limit that triggers the requirement for a company to register its common stock and become a publicly reporting company. The JOBS Act, as written, does not limit the number of crowdfunding investors. If the SEC decides to include crowdfunded investors in the 2,000 investor limit, entrepreneurs will then need to limit the number of small investors (as in only 20 people can invest $200, 30 at $400, etc.). If this were the case, crowdfunding would be more like group funding.

*Any person who owns 20% or more of the company stock will be required to go through a background check, the details of which will be made public on the crowdfunding site (e.g., credit history, tax liens, etc.).

*Any money raised through family and friends prior to the first crowdfunding round will need to be disclosed.

*Investors will be limited to a total annual investment based on their net worth. For those with annual income of less than $100,000 or equivalent net worth, investments are limited to the greater of $2,000 or 5% of their income/net worth. For those whose annual income/net worth exceeds $100,000, they can invest 10% or up to $100,000.

*Regulations will require platforms to use a pop-up box, where investors will read disclaimers and take a quiz ensuring that they understand the high risk associated with such an investment.

*All social media forums will be connected to the crowdfunding platforms and openly shared. Questions raised by potential investors will be publicly available to read, as will the answers to these questions. This includes inquiries pertaining to the business model, financial projections, use of investment monies, etc.

*Entrepreneurs will be limited to solicitation via existing social media contacts. Email/Facebook/Twitter etc. contacts will be uploaded to the government-approved crowdfunding site that the entrepreneur has selected. Entrepreneurs will then solicit from those people via that specific site. Outbound marketing via email or public relations to previously unknown parties will not be allowed.

*Investments will be tracked by affinity circles (i.e., 1st degree is someone from the entrepreneur’s LinkedIn, Facebook, Twitter, etc. connections; a 2nd degree affinity is someone from a 1st degree connection and 3rd degree affinity is someone completely unknown to the entrepreneur but who came to the crowdfunding site).

*It is expected that the vast majority of investors will come from 1st and 2nd degree affinity circles.

Upon reviewing the current JOBS Act provision for crowdfunding, the key conclusion I draw is that it is not going to be as useful to small business America as I had hoped. Unless you have a large social network, savvy communication skills, and a well-conceived business plan, I am not sure that you would feel comfortable navigating these regulatory waters. And would it be worth the time for a small dollar amount (say below $100,000)?

My guess is that existing businesses with a following are probably the most likely to succeed under the new crowdfunding law.

Maybe this is the way it should be? I’m not sure, but time will certainly tell. And nothing will really get going until 2013.

A final note: Sherwood Neiss of StartUpExemption.com provided more insight on this subject than any other person I heard speak or whose articles I have read. He was one of the few laypeople “at the table” with Congress and The White House advocating for this law and advising on the details. I am very grateful to Sherwood for his time and input.