The State of Equity Based Crowdfunding

Washington, D.C.,

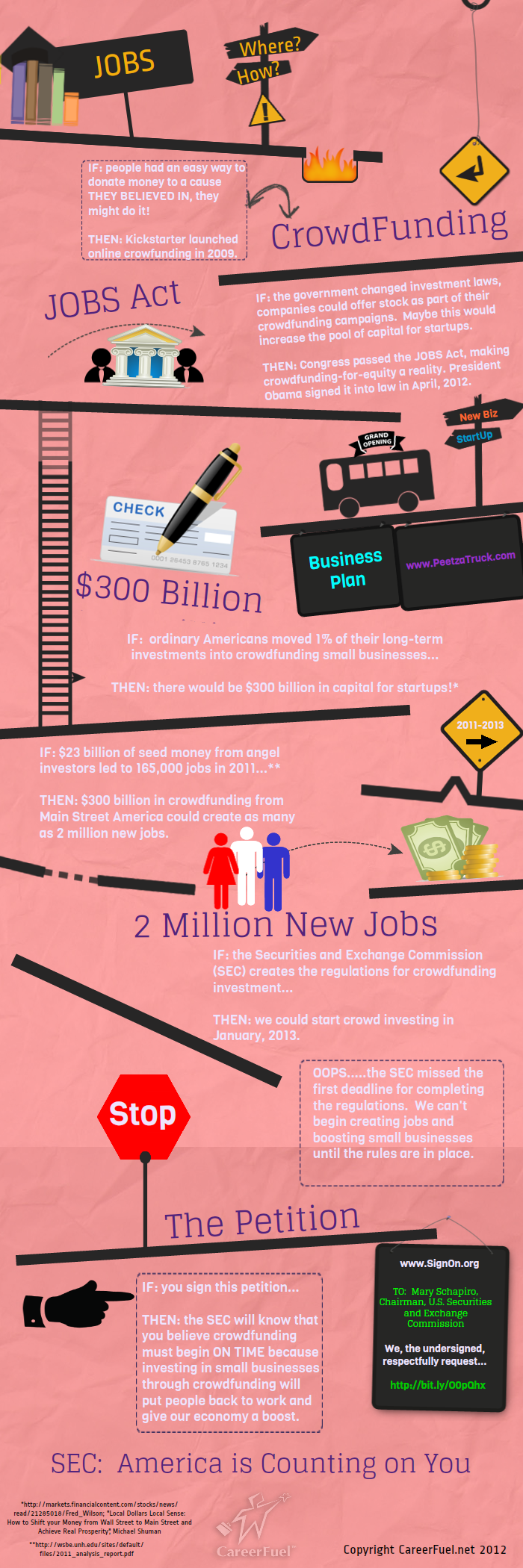

August 24, 2014, 700+ days after the JOBS Act was signed into legislation, the SEC still has not released the final rules for Title III: Regulation Crowdfunding.

Over one year ago, February 19, 2013, the nation’s principal leaders and experts on equity and debt‐based financing providing an in‐depth review of the extensive build out and preparation that has taken place to help entrepreneurs’ access capital through online platforms, while protecting the investors who will finance these enterprises. The group touched upon the global advancement of equity‐based crowdfunding, the significant challenges entrepreneurs still face in accessing capital and why it is vitally important that the SEC finalize JOBS Act rule makings.

Watch the Press Conference:

Moderator and Host: Karen Kerrigan, President & CEO, SBE Council; Panel of Experts: Sherwood Neiss & Jason Best, architects of the crowdfund investing framework that became law through the JOBS Act and Principals of Crowdfund Capital Advisors; Candace Klein, Founder, Bad Girl Ventures and SoMoLend; Ryan Feit, Co‐Founder, SeedInvest; Vince Molinari, President, GATE Technologies; Sara Hanks, CEO, CrowdCheck; Chris Tyrell, Nehemiah Investments; Kim Wales, Founder of Wales Capital and Chair of the Crowdfunding Professional Association [introduced at 25 minute mark]; Judy Robinett, Entrepreneur, Advisor to Early Stage Companies; Doug Ellenoff, Ellenoff, Grossman & Schole, LLP; Chance Barnett, Founder, Crowdfunder